Liberal media are continuing to claim the Biden-Harris Administration’s economic policies were a success – but, hard numbers tell a much different story, regardless of whether the measure is how much Americans are paying, earning or saving.

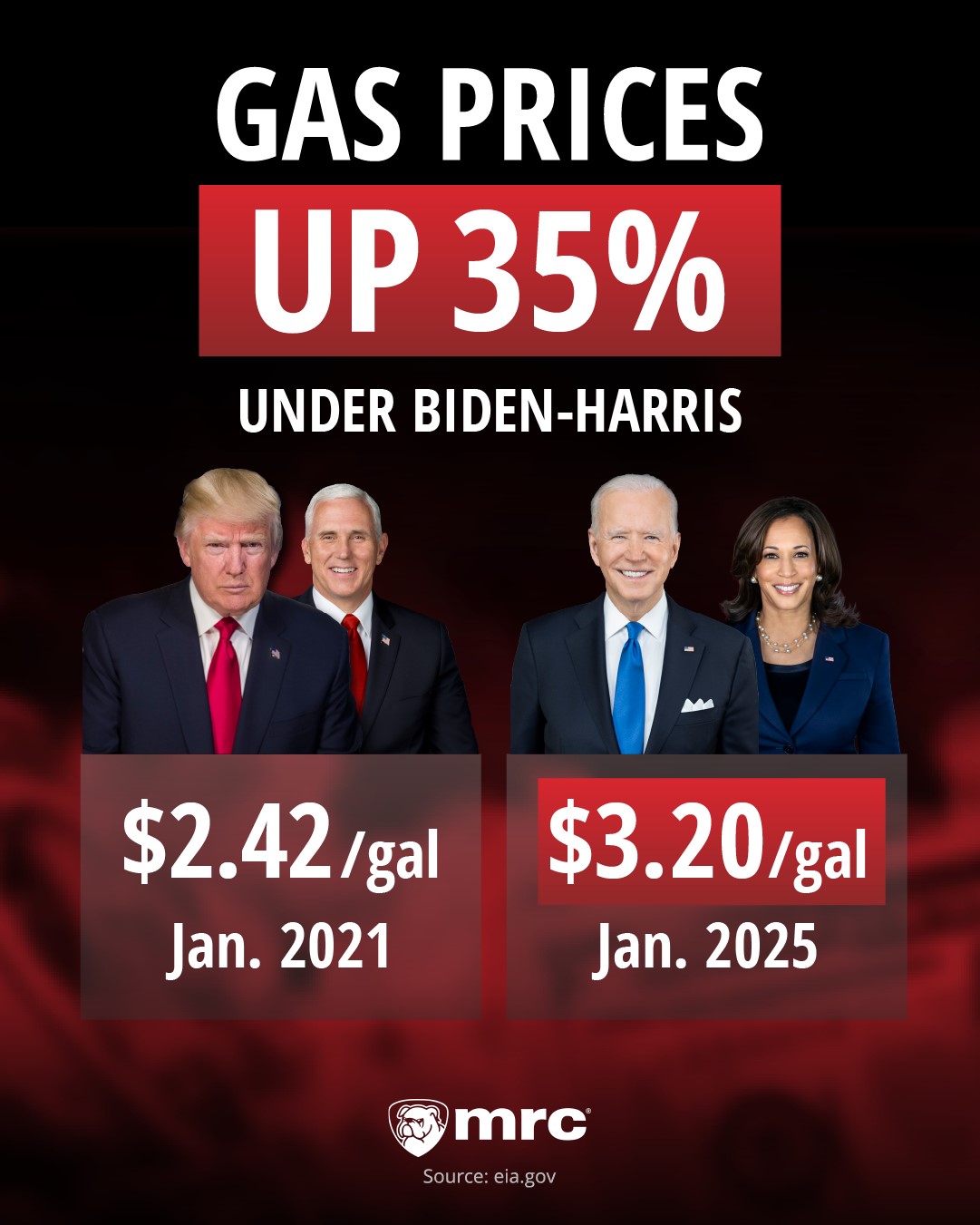

Gas prices:

While gas prices held steady under Pres. Donald Trump (down four cents a gallon), they surged 35% during the 48 months of the Biden-Harris Administration. From January 2021 to January 2025, the average price of a gallon of gas (all grades) increased from $2.42 to $3.20, according to the U.S. Energy Information Administration.

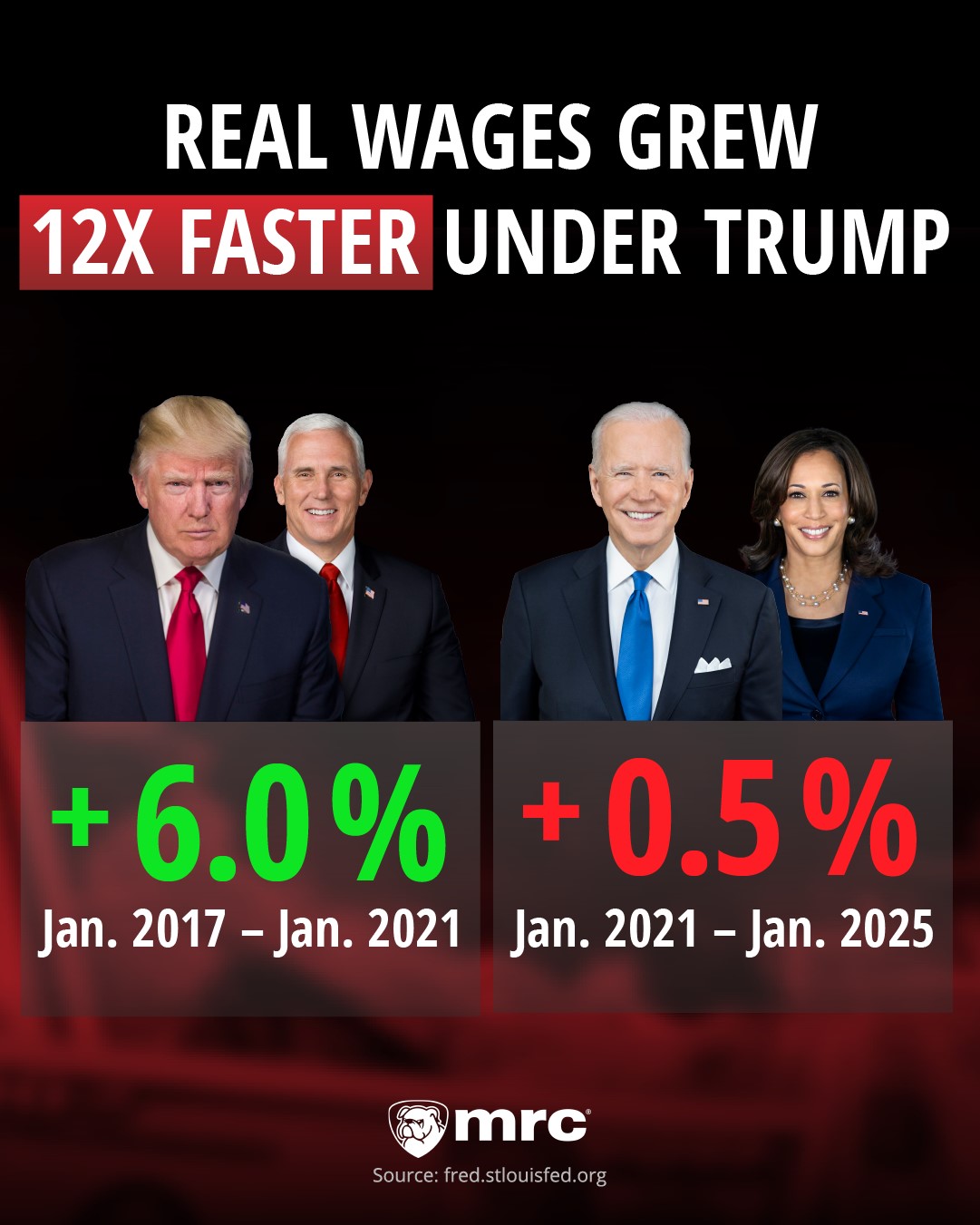

Real Wages

After accounting for inflation, real wages earned by Americans were virtually unchanged, rising just 0.5%, under Biden-Harris. Under Trump, however, real wages rose 12 times faster (up 6.0%), from $352 on January 1, 2017, to $373 on January 1. 2021.

Real wages are calculated using U.S. Bureau of Labor Statistics (BLS) median usual weekly earnings for full-time employees at least 16 years old and are represented in terms of quarterly 1982-84 Consumer Price Index (CPI) seasonally-adjusted dollars.

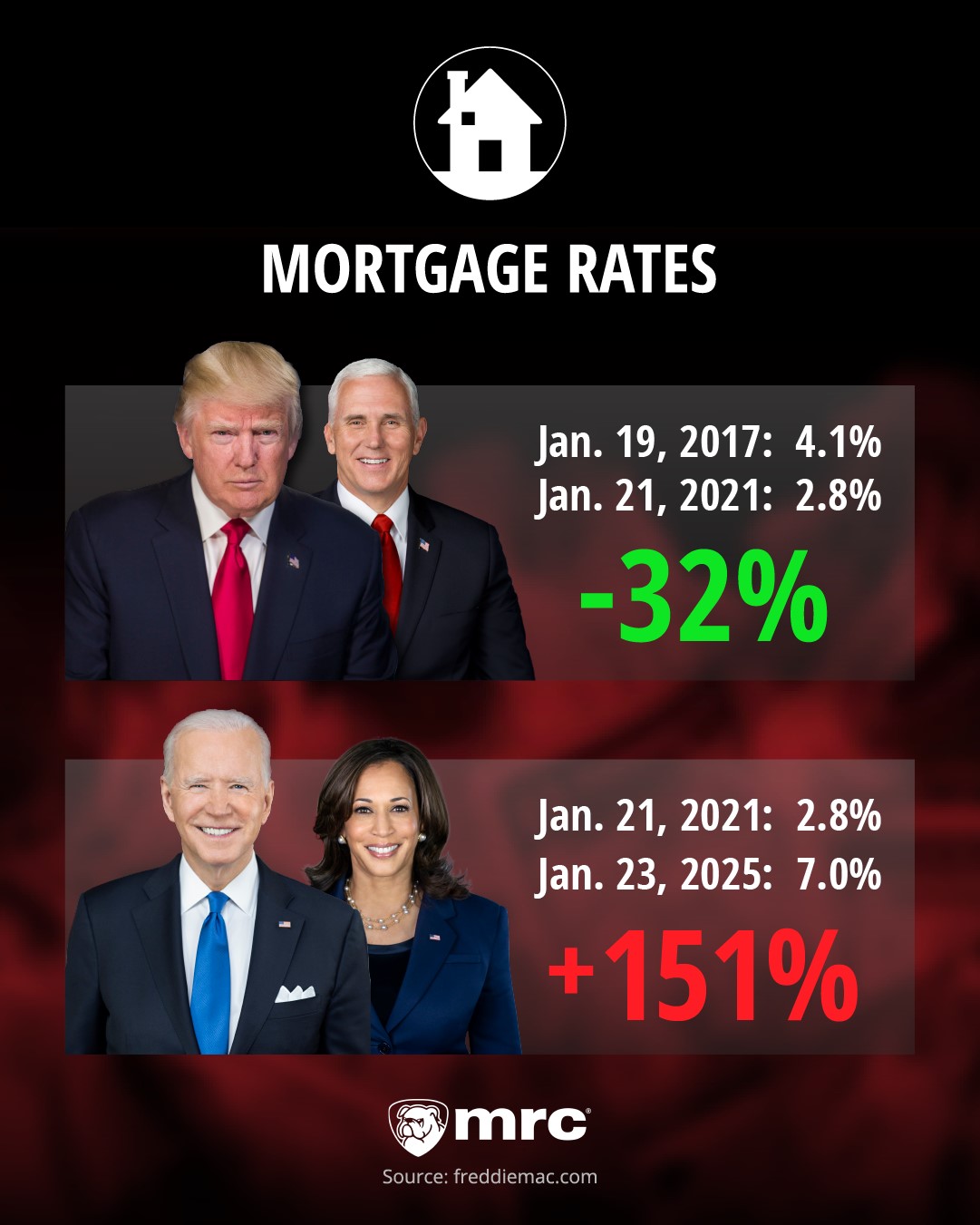

Mortgage Rates:

The cost of financing a home purchase skyrocketed under the Biden-Harris Administration.

From January 21, 2021 to January 23, 2025 the average 30-year fixed mortgage rate jumped 151%, from 2.8% to 7.0%, more than doubling from the end of the Trump Administration, Freddie Mac data reveal. Under Biden’s predecessor, the average 30-year fixed mortgage rate fell by a third, from 4.1% to 2.8%.

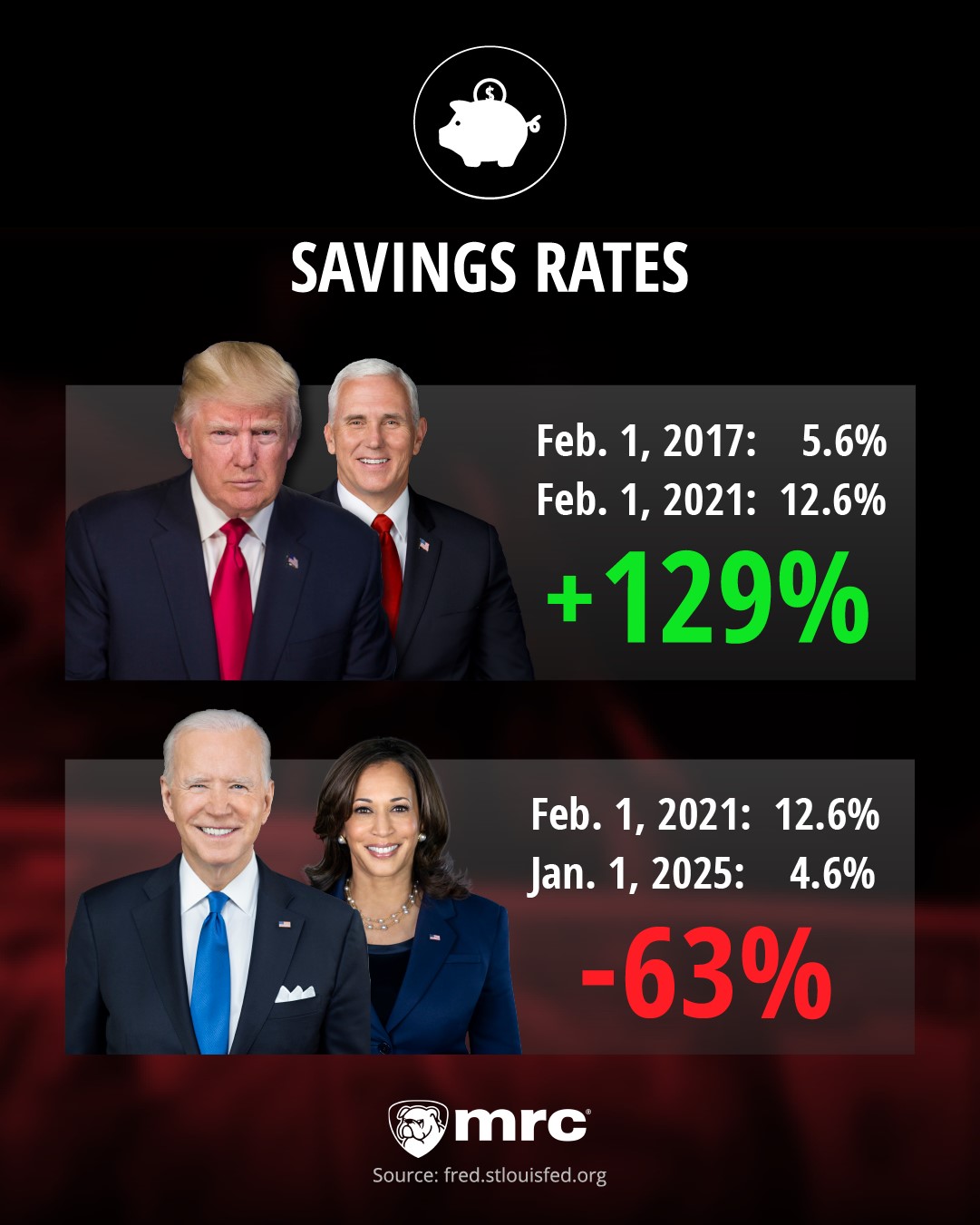

Savings Rates

With Americans having to spend more than their earnings increased, their average savings rate declined under Biden.

From February 1, 2021 to January 1, 2025, the average personal savings rate plummeted 63%, from 12.6% to 4.6%. From February 1, 2017 to February 1, 2021, during the Trump Administration, the average personal savings rate increased 129%, from 5.6% to 12.6%, according to Federal Reserve Bank of St. Louis (FRED) calculations, incorporating BLS data.

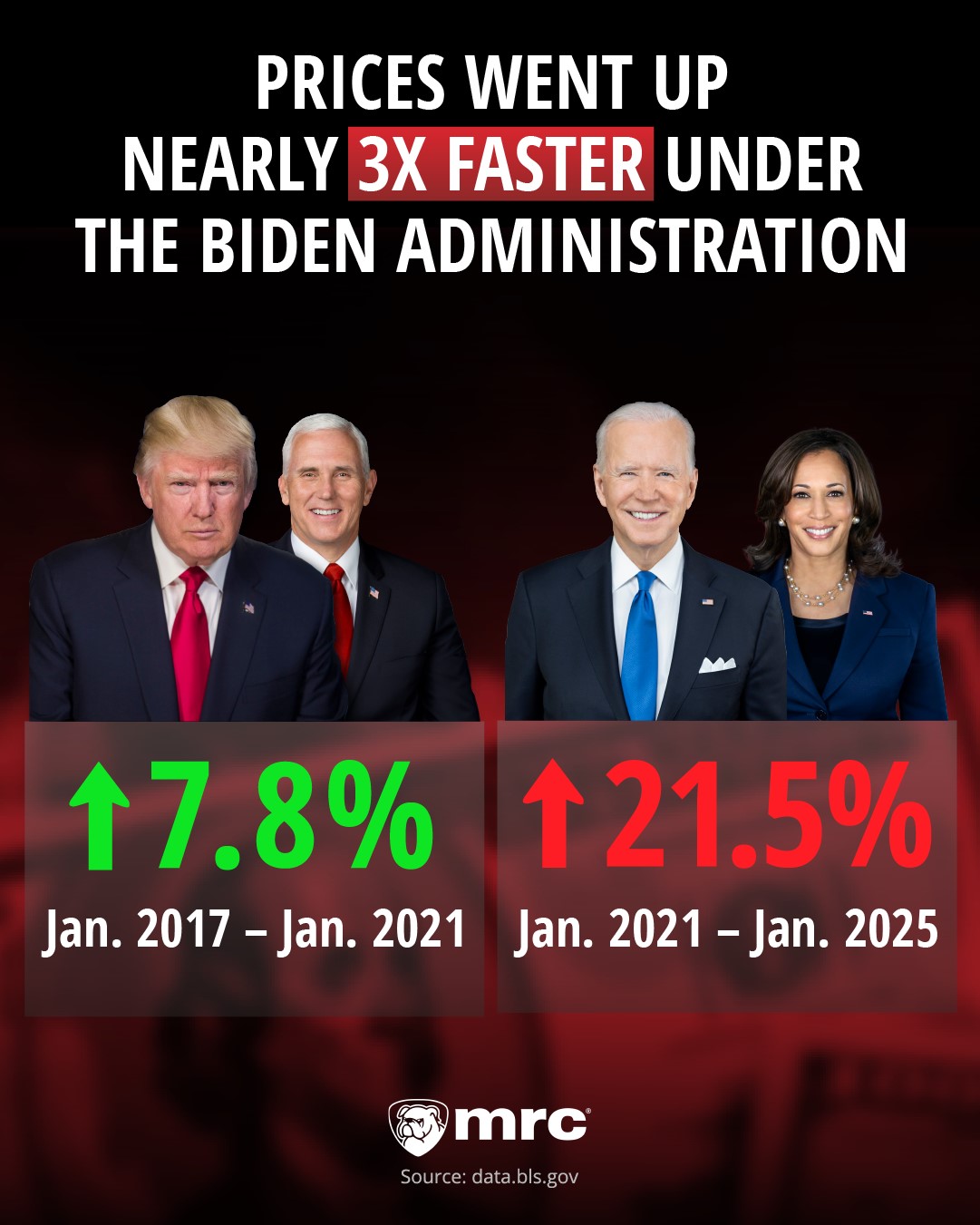

Consumer Price Index:

The Consumer Price Index (CPI) rose nearly three times faster under Biden than under Trump. From January 2021 to January 2025, consumer prices increased 21.5%. In contrast, from January 2017 to January 2021, the CPI rose 7.8%.

On a monthly basis, inflation averaged 1.9% under Trump (Feb. 2017-Jan. 2021), compared to 5.0% under Biden (Feb. 2021-Jan. 2025).